Find the best credit card deals today – Victory Best

A card is a financial tool issued by banks or financial institutions that allows you to borrow funds to pay for goods and services. The key features of a card include: Are you seeking a card that matches your lifestyle and financial goals? Look no further! We’ve curated the best card Offers to help you save money, earn rewards, and enjoy exclusive perks. Find the best credit card deals today can make a huge difference in your financial journey. Whether you’re looking for the best credit card Offers

Find the Best Credit card deals

| HDFC Shoppers Stop Card |

| T&C apply | |

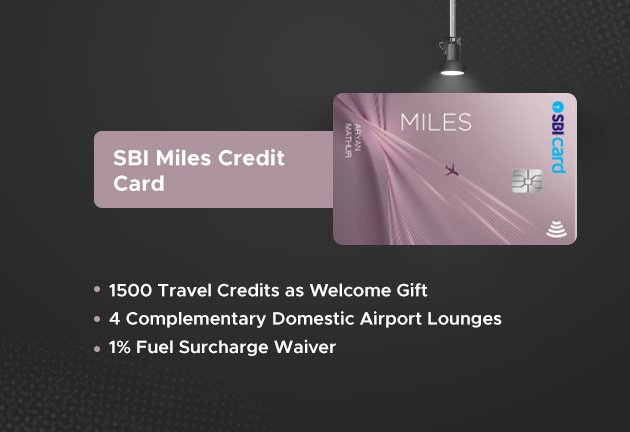

| SBI Miles Credit Card |

| T&C apply | |

| ICICI Bank – Elevate Every |

| Joining Fees: Free | |

| Axis Indian Oil Rupay |

| T&C Apply | |

| HSBC |

| Lifetime FREE |

Image | Product | Features | Price | View |

|---|---|---|---|---|

| SBI Simply Click |

| Annual Fee Rs. 499 + | |

| Swiggy HDFC Card |

| Free | |

| Axis MyZone Credit Card |

| Joining Fees: Rs 500 | |

| IDFC FIRST Credit Card |

| T&C APPLY | |

AU Altura Credit Card |

| Joining Fees: Rs 199 |

Key Features:

- Credit Limit: The maximum amount you can borrow, determined by your creditworthiness.

- Monthly Billing Cycle: Transactions made during the cycle are billed at the end of the period, and repayment is due on that date.

- Interest Rates (APR): If the balance isn’t paid in full by the due date, interest is charged on the remaining balance.

- Rewards and Benefits: Best cards offer rewards like cashback, travel points, and discounts.

- Security: Cards often include fraud protection and zero liability for unauthorized transactions.

How to find the best credit card?

Apply. To apply for a card, fill out the online application. You only need a few personal details and in some cases proof of income

How It Works:

- Purchases: You use the card to buy goods or services up to your credit limit.

- Repayment: Pay the full amount or at least the minimum payment by the due date. Carrying a balance results in interest charges.

- Fees: Credit cards may have annual fees, late payment fees, or fees for cash advances.

Types of Credit Cards:

- Rewards Cards: Earn points, miles, or cashback on purchases.

- Balance Transfer Cards: Offer low or 0% introductory rates for transferring balances from other cards.

- Travel Cards: Provide benefits like airline miles, hotel points, and no foreign transaction fees.

- Secured Cards: Require a deposit as collateral, designed for those building or repairing credit.

- Student Cards: Tailored for students with lower limits and rewards.

Benefits:

- Convenience: Easy payment method, accepted worldwide.

- Credit Building: Helps establish or improve your score if used responsibly.

- Emergency Access: Provides access to funds during emergencies.

- Rewards and Perks: Earn incentives for everyday spend

Find the best credit card For You

Find the best credit cards by comparing a variety of offers for balance transfers, rewards, low interest, and more. Apply online at Victory Best